- Home

- Free Samples

- Financial Accounting

- HA3011 Advanced Financial Accounting ...

HA3011 Advanced Financial Accounting Tutorial Questions Assignment 1 Answer

Assessment Task – Tutorial Questions Assignment 1

Unit Code: HA3011

Unit Name: Advanced Financial Accounting Assignment

Weighting: 25%

Total Assignment Marks: 50 Marks

Purpose:

This assignment is designed to assess your level of knowledge of the key topics covered in this unit

Unit Learning Outcomes Assessed:

- Understand the various theoretical models of accounting

- To apply knowledge and understanding to specific financial reporting issues unit to AASB Accounting standards

- Discuss the theoretical constructs of contemporary financial accounting

- Evaluate and explain the need for the development of a conceptual framework for Accounting, and discuss the influence of such a framework on accounting practice.

- Understand the Australian accounting regulatory framework and the conceptual framework

- Be able to understand how to account for assets, non-current assets and liabilities

- Be able to calculate for revaluations and impairments of non-current assets, and then journalise

- Account for leases for both lessees and lessors.

- Account for company income taxes

- Accounting for the extractive industries

Description: Each week students were provided with three tutorial questions of varying degrees of difficulty. These tutorial questions are available in the Tutorial Folder for each week on Blackboard. The Interactive Tutorials are designed to assist students with the process, skills and knowledge to answer the provided tutorial questions. Your task is to answer a selection of tutorial questions from weeks 1 to 5 inclusive and submit these answers in a single document.

The questions to be answered are;

Week 1 Question (10 marks)

It is argued by some researchers that even in the absence of regulation, organisations will have an incentive to provide credible information about their operations and performance to certain parties outside the organisation; otherwise, the costs of the organisation’s operations will rise.

What is the basis of this belief?

Week 2 Question (10 marks)

What force of law does the conceptual framework have?

Week 3 Question (10 marks)

Under Positive Accounting Theory, what are agency costs of equity and agency costs of debt? Is it possible to put in place mechanisms to reduce all opportunistic action? If not, why not?

Week 4 Question (10 marks)

TXA Ltd acquired a machine from Blue Ltd for the following consideration:

- Cash $70, 000

- Land in the books of TXA Ltd the land is recorded at its cost of $650,000. It has a fair value of $450,000.

TXA Ltd also agrees to assume the liability of the Blue Ltd bank loan of $89,000 as part of the machine acquisition.

Required:

- Calculate the acquisition cost of the machine. (2 marks)

- Provide the journal entries that would appear in TXA Ltd.’s books to account for the acquisition of the Machine. (8 marks)

Week 5 Question (10 marks)

Max Ltd acquires an item of machinery on 1 July 2016 for a total acquisition cost of $61,000. The life of the asset is assessed as being six (6) years, after which time Max Ltd expects to be able to dispose of the asset for $6,000. It is expected that the benefits will be generated in a pattern that is best reflected by the sum—of—digits depreciation approach. On 1 July 2019, owing to unforeseen circumstances, the machinery is exchanged for a motor vehicle. Note the motor vehicle is two years old, originally cost $17,000 and has a fair value of $11,000.

Required:

Provide the necessary journal entries for the disposal of the machinery and the acquisition of the motor vehicle.

Answer

Advanced Financial Accounting

Week 1

With the proper transparency of the data, organizations win the trust of the stakeholders in market. Some of the researchers believe that organisation may provide credible information about their operations and performance to certain parties outside the organisation in the absence of regulation. Also, they believe that the presence of regulation will increase the costs of organisation's operations.

The basis for this belief is that there are certain concepts in the conceptual framework for accounting that have not been completely covered and discussed by the standards or rules of accounting. Researchers believe that the use of such concepts from the conceptual framework will enhance the level of information provided by the organisation. However, these concepts are not mandatory to comply with until any standard by the regulating authority covers them (Weil, Schipper., & Francis, 2013).

Accounting standards are issued and developed in accordance with the rules and regulations. Also, they are developed under certain rules, they are mandatory in nature to be complied by the organisations. To ensure the compliance of these standards, organisation has to appoint an additional professional which increases the cost of the company (Weygandt, Kimmel, & Kieso, 2015).

However, the belief of these researchers is not up to the mark because it is necessary to have rules and regulations for the organisations as the financial information by them affects many of the people. The regulation makes organisation to prepare and present the information by following certain standards, and these standards are developed to protect the interest of the people associated with the organisation, directly or indirectly. For example, investors make investments decision on the basis of the returns and other factors shown in the financial statements of the organisation. If regulation does not exist then there are chances that he might get incorrect information. Hence, it is necessary to have regulations in place.

Week 2

Conceptual Framework

Conceptual Framework may be referred to as a collection of board principles that are taken into consideration while making business decisions. It is a rational and logical system that provides concepts for financial reporting. The financial statements are prepared and presented for external users on the basis of the conceptual framework.

A conceptual framework is different from the standards set up for accounting. Accounting standards provide those concepts that can be applied only to specific financial transactions. However, the conceptual framework provides an extended level of concepts to define the purpose, elements, and features of financial reporting. An accounting standard and amendments thereto are set up on the basis of the conceptual framework (Keneley, & Jackling, 2011).

Accounting standards have legal force but the conceptual framework does not have. Reporting entities are legally required to follow the accounting standards; however, there is no such requirement for the conceptual framework.

To bridge the gap between the requirements of accounting standards and conceptual framework, new accounting standards are embedded with the concepts of the conceptual framework. Hence, the concepts of conceptual framework gain legal force once they form part of accounting standards.

A conceptual framework has assisted the International Accounting Standards Board (IASB) in the development of IFRS(s), however, the conceptual framework requires some revision as it does not cover some significant areas, and some of its concepts are ambiguous and outdated. Therefore, IASB had taken the responsibility to revise some concepts of the conceptual framework (Cain, Denis, & Denis, 2011).

An entity reports its financial information to external users as per general purpose financial reporting concepts from the conceptual framework. The reported financial information helps external users for making investment decisions. The revision in the conceptual framework has proven to be as restrictions over users and decisions, and it has also hampered the accountability of the reporting entity.

Week 3

Positive Accounting Theory and Agency costs

Positive accounting theory may be referred to as the theory that aims to predict and explain the real accounting practices.

Agency costs may be referred to as cost that has incurred due to the conflict between shareholders and the management of the company. The reason for such conflict is that the managers are taking such business decisions that give benefits to them or results in business expansion; however, the shareholders wants managers to take such business decision that may provide benefits to them. There are 2 types of agency costs i.e. agency cost of debt and agency cost of equity (Weygandt, Kimmel, & Kieso, 2009).

Agency cost of equity is a cost that is bear by the shareholders when there is a conflict of interest between shareholders and management. It is a cost that is incurred by the shareholders to keep a check on the decision making of the management (Baker, et al. 2012).

The agency cost of debt is the cost that is incurred at the time of conflict between the interest of shareholders and debt holders. The debt holders put restrictions to use their money. The debt holders take higher interest rates as a preventive measure to be protected against conflict. This results in the agency cost of debt (Horngren, Bhimani, Datar, Foster, & Horngren, 2012).

It is very difficult to put in place mechanisms to reduce all opportunistic action because one cannot deal with the agency problems without incurring the cost. A new monitory technique may be introduced in the company to reduce agency costs. This new technique may include preparing budgets, follow accounting procedures, etc. that may totally remove or limit the agency costs. These costs affect both company and shareholders. Hence, it is the responsibility of both shareholders and the managers to make business decisions based on prudence and vigilance.

Week 4

(A). Calculation of cost of acquisition

| Particulars | Amount ($) |

| Cash Paid | 70,000 |

| Land | 4,50,000 |

| Liability of Blue Ltd Bank Loan | 89,000 |

| Cost of acquisition | 6,09,000 |

Note: As per the requirements of the accounting standards, the fair value of assets given is taken in the calculation of the cost of acquisition.

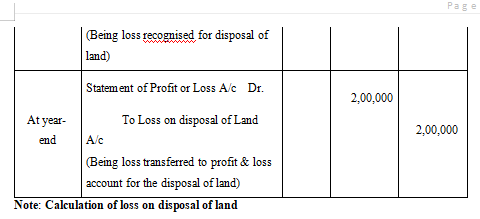

(B). Journal Entries in the books of TXA Ltd. for the acquisition of the machine

Note: Calculation of loss on disposal of land

| Particulars | Amount ($) |

| Book Value of Land | 6,50,000.0 |

| Less: Fair Value of Land | -4,50,000.0 |

| Loss on disposal of land | 2,00,000.0 |

Week 5

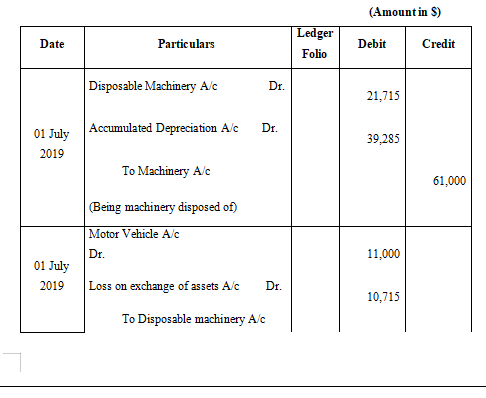

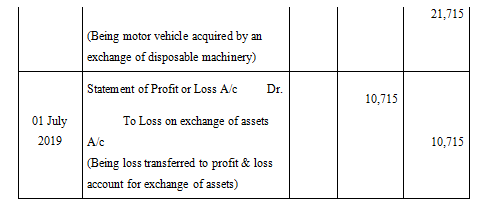

Journal Entries in the books of Max Ltd. as on 1 July 2019

Note: Calculation of Accumulated Depreciation

Cost of Machine = $61,000

Life = 6 Years

Salvage Value = $6,000

Depreciable Amount = $61,000 - $6,000 = $55,000

As per sum of digits approach,

Total weighted years = 6 + 5 + 4 + 3 + 2 + 1 = 21 years

On 1 July 2017,

Depreciation (A) = $55,000 * (6/21) = $15,714

Carrying Amount of Machinery = $61,000 - $15714 = $45,286

On 1 July 2018,

Depreciation (B) = $55,000 * (5/21) = $13,095

Carrying Amount of Machinery = $48,286 - $13,095 = $32,191

On 1 July 2018,

Depreciation (C) = $55,000 * (4/21) = $10,476

Carrying Amount of Machinery = $32,191 - $10,476 = $21,715

Accumulated Depreciation (A)+(B)+(C)=$39,285