- Home

- Free Samples

- Financial Accounting

- HA2042 Accounting Information System...

HA2042 Accounting Information Systems Tutorial Assignment 1 Answer

Assessment Task – Tutorial Questions Assignment 1

Unit Code: HA2042

Unit Name: Accounting Information Systems Assignment: Tutorial Questions Assignment 1

Weighting: 25%

Total Assignment Marks: 50 Marks

Purpose:

This assignment is designed to assess your level of knowledge of the key topics covered in this unit.

Unit Learning Outcomes Assessed:

- Understand and explain the environment in which accounting information systems are constructed and operated.

- Understand and explain the place of an accounting information system in the context of the organisational structure and operating practices.

- Identify, analyse and compare different types of accounting information systems.

- Use different methodologies to evaluate various accounting information systems.

Description: Each week students were provided with three tutorial questions of varying degrees of difficulty. These tutorial questions are available in the Tutorial Folder for each week on Blackboard. The Interactive Tutorials are designed to assist students with the process, skills and knowledge to answer the provided tutorial questions. Your task is to answer a selection of tutorial questions from weeks 1 to 5 inclusive and submit these answers in a single document.

The questions to be answered are:

Week 1 Question (10 marks, maximum 250 words)

What three transaction cycles exist in all businesses? Name the major subsystems of the three (3) cycles.

Week 2 Question (10 marks, maximum 200 words)

Using the diagram above, answer the following questions:

- What do the symbols for “Vendor” and “Invoice” represent?

- What does the operations involving “AP Dept”, “PO”, “Rec Rept”, and “Invoice” and “T” depict?

Week 3 Question (10 marks, maximum 250 words)

Discuss the potential aggravations you might face as a student as a result of your university using a flat-file data management environment.

Week 4 Question (10 marks, maximum 300 words)

Explain why each of the following combinations of tasks should or should not be separated to achieve adequate internal control:

- Approval of bad debt write-offs and the reconciliation of accounts receivable subsidiary ledger and the general ledger control account.

- Distribution of payroll cheques to employees and approval of employee time cards.

- Posting of amounts from both the cash receipts and the cash disbursements journals to the general ledger.

Week 5 Question (10 marks)

Question 3 – TBA (10 marks)

Answer

HA2042

Week 1

Transaction Cycles

Transaction cycles are used to trace the transactions at the different levels of the operational activities. As business has huge volume of transactions affecting on daily basis, it is necessary to maintain a proper system of tracking these financial transactions at each level. Transaction cycle may be referred to as cycle that shows financial transactions on the basis of their nature. Every business has 3 types of transaction cycles (Lin, and Yu, 2012).

- Expenditure cycle: Expenditure cycle tells about the costs incurred by the company in its operations. It helps to understand the decisions of the customers for buying the products or services.

- Conversion cycle: Conversion cycle tells about the aspects covered in process of converting the raw materials into finished goods. It helps to determine the number of days taken by the organisation in converting the capital invested into the final products (Lin, and Yu, 2012).

- Revenue cycle: Revenue cycle tells about the aspects related to the sales or revenue of the organisation. It helps to ascertain and determine the transactions that are related to sale of products and services. Also, it tells about the expenses that are related to the sale of products and services (Lin, and Yu, 2012).

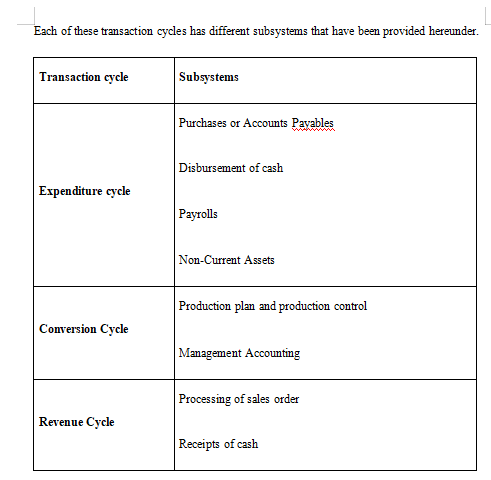

Each of these transaction cycles has different subsystems that have been provided hereunder.

Week 2

A.

| Vendor | Vendor is the supper of the raw material of the company. Which provide the material of the company after receiving the order from the purchasing department of the company and received the check in consideration of material provided by him from the appropriate authority I the company (Penman, and Zhang, 2019). |

| Invoice | Invoice the document that has been issued by the receiving department after receiving the purchasing order. This invoice document contain the details of the all the quantity of required material that has to be purchased from the vendor of the company (Penman, and Zhang, 2019). |

B.

AP department means the account payable department who provide the details of the purchasing order and their respective balance to be paid with concern supplier. After receiving this detail, it will move on to reconciliation of invoice details with reconciliation receipt that have been received earlier. Then it will forward to the Treasure department to prepare the cheque for the payment to the supplier. If all the process found satisfactory then treasure department will issue the cheque to the concern authority for sign and distribute to relevant vendor. This is also known as the segregation of duties to improve the internal control of the company (Unger, 2016). It helps in dividing the duties to the different person and authority in the department.

Week 3

File Flat data management

File Flat data management is one of the methods to design the channel of data and instructions of program. In file flat data management system, a specific data file is created for every application. The reason to follow this system is the barriers that prevent the integration of data and lack of technology. In this system, individual creators own the flat file and the data is not supposed to be shared between the other users. This makes this system a separate individual task and not the collective or team task (Ariana, and Bagiada, I2018). With the proper database management, company could easily manage the process data program which helps in data mining and recording of the confidential information.

As a student, following aggravations may be faced for the usage of flat file management environment in the university.

- The data in the flat file management system does not have adequate security. Anyone can extract the data and may misuse it.

- It helps in developing the secure system to protect the required confidential data .

- The data in this type of system may be inconsistent.

- Student may face the issue of data redundancy in the flat files developed through this system.

- This system has lot of concerns in sharing of the data. The data sharing ability of this system is not that much efficient.

- In cases of huge data base, this system may act slower than the speed of tortoise.

- It helps in strengthen the flow of information from one process to other.

- Flat file data management is going to consume more time in searching process.

However, the data in this system is easy to understand and implement. For this reason, many of entities with small database are using this legacy database system as it requires less skills and less hardware or software knowledge (Ariana, and Bagiada, 2018).

Week 4

| Case | Treatment | Explanation |

| A | Should be separate | Bad debts written off and reconciliation of debtors should be separately handle by the different line of person. As it will help to discover the error if the bad debts has been written off debtors amount which should not be written off and debtors manager will also require to seek the evidence and approval of the management for such written off. Then after it has be posted in general ledger after receiving the satisfactory evidence concerning to this matter (Nabila, 2017). |

| B | Should not be separate | For establishing the strong internal control in the payroll system there should be the same person who provide the check to the employee and responsible for the time card of the employee. Because he can analyse the time management to the employee and can help to provide check as per the working hours of the employee which lead to save unwanted cost of the company toward the employee. This will not just improve the internal control of the company but also provide the responsibility towards the employee and distributor of employee cheque so that employee cannot take the advantages of the weak system (Lin, and Yu, 2012). |

| C | Should not be separate | It would be easy to reconcile the cash receipt and disbarment if the both amount to be shown in the same ledger and posted through the same journal by the same person (Ariana, and Bagiada, 2018). As one person can provide the deep focus if he has appointed to be responsible in this concern only and report to the top management with meaningful information for any decision making. If the error is notice has occur then it can provide the huge havoc in the financial statement therefore it require to appoint the same person to increase the focus and it will improve the internal control too (Ariana, Bagiada, and Sukayasa, 2018). The proper system process and internal control department is set up to strengthen the work program and align the recording system with the reporting framework. |

Week-5

The transaction processing system is accompanied with the process program which is based on the procedural work of the individual. The batch mode and online mode are accompanied with the two approaches of the transactions processing system. The main feature of undertaken system is accompanied with the performance reliability and performance consistency. It provides the aid the business approaches in various operations from the different database.

The management reporting system- this is done with a view to strengthen the reporting framework and undertake the reporting more transparent. It provide the required information to the stakeholders which help them to make the effective strategic investment decision (Kozlovská, et al. 2015).

Impact of the E-commerce on the technical and non-technical stakeholders

It is considered that the E-commerce is accompanied with the various growing stages and aligned with the advance technology to attract more clients in market. The alignment of the technology has opened various business ways and lower down the complexities to do business. However, there are several ways such as Business to business, business to customer and customer to customer. The E-commerce is used by origination to enhance the marketing among the clients (Lin, and Yu, 2012). With the alignment of the advance technology, it helps to ascertain and determine the transactions that are related to sale of products and services. Also, it tells about the expenses that are related to the sale of products and services. There is need to set up strong relation between the data and information to make the effective strategic decision making and develop the system. However, with the advancement in technology, there has been increasing cases of the cyber attacked to misuse the confidential information. However, with the advancement in technology, E-commerce could be used to attract more clients and strengthen the sales by the business organisation (Lin, and Yu, 2012).