- Home

- Free Samples

- Business Finance

- FIN200 Important Factors Of Defined B...

FIN200 Important Factors Of Defined Benefit Plan Assessment 2 Answer

FIN200 CORPORATE FINANCIAL MANAGEMENT T320

Assessment 2

Assessment Type: Individual assessment. 2,000 word. Essay

Purpose: Students are to analyse the given information, doing relevant research regarding Defined Benefit Plan and Investment Choice Plan and create relevant, supported conclusions and make justified recommendations to given issues and problems. This assessment contributes to learning outcomes a, b and c.

Topic: What do you think are the important factors that should be considered by tertiary sector employees when they are deciding whether to place their superannuation contributions in the Defined Benefit Plan or the Investment Choice Plan? What issues relating to the concept of the time value of money, taxes etc., might be important in this decision-making process?

Students are to analyse the given information, doing relevant research regarding Defined Benefit Plan and Investment Choice Plan and create relevant, supported conclusions and make justified recommendations to given issues and problems. Responses are to be formatted into a professional report/essay, as would be expected of someone working in a modern accountant’s or financial advisor’s office.

Presentation: 2000 words +_ 10%, typed in word .doc essay format; title page, introduction, suitable headings and subheadings, conclusions and recommendations, reference list (Harvard – Angelia style), attachments, e.g. spreadsheets.

Research Requirements: Students need to support their analysis with reference from the text and a minimum of (6) suitable and reliable, current and academically acceptable sources – check with your tutor if unsure of the validity of sources. Students seeking Credit or above grades should support their analysis with increased number of reference sources comparable to the grade they are seeking.

Answer

INTRODUCTION

In the modern era, corporate finance is said to be areas of finance that directly deal with a specific source of capital, the structure of an organization, and action that accountants take to enhance the value of the firm. However, the act of developing strategies and making investment-related decisions that would positively impact the operation of an organization is aligned with corporate finance (Paramasivan and Subramanian, 2020). Therefore, this project report tends to provide vital information regarding important factors that could be taken into account by tertiary sector employees by placing its superannuation funds to Define Benefit plan. Apart from this, an analysis of key issues related to the concepts of the time value of money and taxes over the decision-making process is also been highlighted in the report. Furthermore, some of the valuable suggestion to deal with challenges regarding the capital sources is provided wisely.

ANALYSIS

Important factors of Defined benefit plan

In the entire working tenure, most employers provide different retirement benefits to their employees both due to a voluntarily to retain employees for long-term. It normally consists of provident funds, gratuity, NPS (National Pension System), and many more. Similarly, a superannuation benefit is one of the retirement benefits which are offered to existing employees by the organization. Most of the time employees ignore this particular benefit, but might not even know that they could have been liable for such offers. Moreover, it intends to become imperative to examine that superannuation benefits are the potential to assist individuals to have better financial planning and sustain their retirement efficiently for the rest of their life (Alshehhi, Nobanee, and Khare, 2018). However, an employer mainly contributes to these benefits on behalf of an employee towards group policy. The firm either organize superannuation capital by its trust or open a benefits fund with any approved insurance agency. In most of the situation, an employer contributes a fixed percentage that is more than 15% of total basic pay along with dearness allowance (DA). It has also been noted that an employee might also switch for voluntarily contributing as an additional value of capital in a situation of a defined benefit plan. During the time of retirement, it can easily withdraw up to 1/3rd of accumulated profits and transfer the rest of the balance into a regular pension to get a regular return at selected intervals. Apart from this, once an employee changes his job, then it has no option to transfer the superannuation funds to a news organization. Meanwhile, some of the important factors that tend to be taken into account by tertiary sector employees, while deciding whether to place its superannuation funds in the defined benefit plan.

Defined benefit plan: It happens to be an employer-sponsored retirement scheme, where the advantage is computed on key factors like salary and duration of service. It tends to have various benefits such as an employer’s get a tax deduction from total contribution to DBP. However, it can also keep the individual with a firm for the long-term as they wait to earn the maximum retiree benefits. A wide range of factors that could affect the benefits generally covers territory workers from retirement benefits plan (Cho and Lee, 2019). For a Defined benefit plan, these factors consist of benefits formula, retirement age, length of service, and pre-retirement income. However, benefits might also be getting affected once the participant is in a plan offering for post-retirement increased.

Benefit formulas: Some of the terminal income base formulas are considered as the most prevalent approach used to evaluate retirement benefit payments. The majority of employees in medium and wide private establishment’s part in a defined benefit plan is subject to the terminal income base formula. 78% of public sector employees and 37% of private-sector staffs with a terminal income formula have a pension benefit based on a flat percent.

| Private sector benefit formulas | Percent |

| Total defined benefit plan | 100 |

| Formula type | |

| Terminal income | 58 |

| Dollar value | 23 |

| Career earning | 11 |

| Cash amount | 3 |

| Percent of contribution | 2 |

| Other | 2 |

Normal retirement: The potential age at which staff retires affects the value of benefits gets during the time. Around 65 are often considered as usual retirement age that most workers participate in a plan that tends to permits retirement (VanDerhei, 2016). On the other hand, public sector participants 43% will retire at any age after satisfying a service need, although 30 years is proposed. In contrast, over 48 % of complete private sectors participant intends to have a minimum age of 65 for taking normal retirement as compared to 8% of public sectors.

Post-retirement pension growth: In the case of inflation that could seriously erode the buying ability of a retiree pension advantage. To deal with this erosion, a certain plan specifies automatic growth on change in CPI (consumer price index). Some employer tends to provide a discretionary growth to adjust retiree benefits plan for inflation (Bodie, Marcus, and Merton, 2018). For example, it is often restricted to a range of CPI movement, generally, 3% or less could apply to them.

Contribution: Defined benefit plan is different largely in the total value of a specific firm and employee’s contribution that could be made effective to the individual. A saving plan is most prevalent from a defined contribution plan which usually needs a basic employee fund that is subject to employers contribution. In most plans, it permits voluntary employee benefit over the total value-aligned by the employers.

Issues related to time value of money and tax

In any investment plan, it has been important to have a proper understanding of the specific aspect that can impact the benefits of the plan. Time value of money is a major concept that shows money of employees current is worth more than its identical sum in the future because of potential income capacity. The core fact of finance keeps that provided income could earn interest as well as any value of money is worth higher the sooner it is retained. For example, if a dollar currently is worth higher than a dollar tomorrow. However, various factors could affect the time value of money such as time of investment rotation, yearly interest rate, present, and future value. In most situations, one of these key factors will be equal to zero, thus the issues would effectively have only these variables (Tanggamani, Amran, and Ramayah, 2018). It has been determined that TVM is considered valuable because it provides people to make a more systematic decision regarding retirement benefits. However, it could also assist employees to weigh the pros and cons option that might be suitable based on interest, inflation, and risk factors. In simple term, it can be a good option to measure to intensity of goals which is planned by the employees after the retirement. Therefore, it is taken into account as a valuable source of financial planning and provides a reliable idea to reach their desired goals effectively. To calculate TVM, the following element is required to be considered.

FV: PV *(1+I)^N

Where,

FV: Future value

PV: Present value:

I: Investment

N: Number of years.

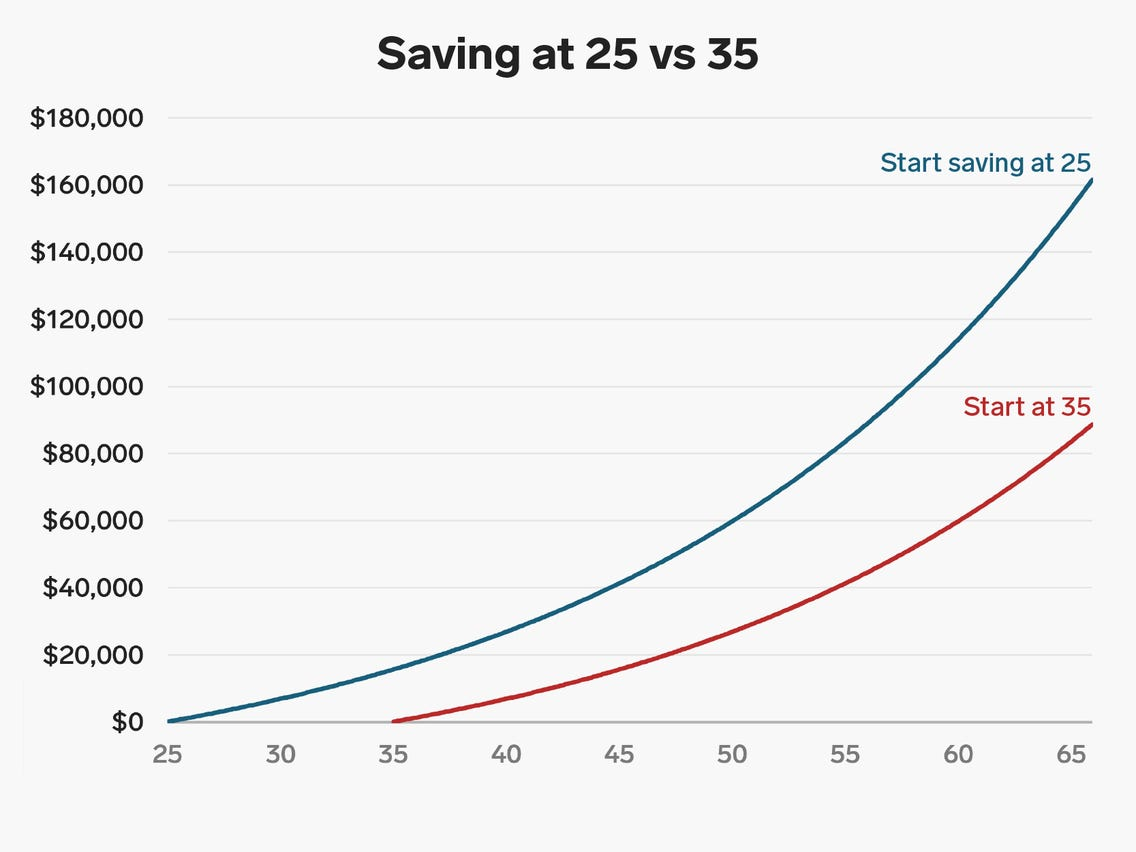

Thus, it is a critical aspect to retirement planning, because if someone begins investing might be the one of the valuable factors in total size of retirement plan. It can be further understood through the below-mentioned chart that represents the investment at the two different age scenario.

(Source: Business insider, 2018)

From the above chart, it has been identified that if an employee’s invest at the age of 25 it can gain maximum saving as a return in its retirement age. It means, the future value (FV) is providing $160000, whereas the FV of another person is only generating $90000 profit. Similarly, if employees decide to save income at the age of 34, then the chances of getting a higher return are relatively low as compare to the earlier age. Therefore, it is always considered suitable to start saving at the 25 age to enjoy the retirement facilities.

Tax issue: In retirement planning, a tax is also creating certain complications for the employees. In this case, employees receive income from their traditional 401(K), 403 (b), or 457 salary reduction plan, it mainly owes income tax on these values. Therefore, this income that is produced by the combination of employee’s contribution is taxed at its regular rate. However, the capital retained as superannuation is been exempted from tax, if it is paid on employee death, retirement, or as an annuity (Hanrahan, 2018). It has been determined that any amount received as leave encashment by the state as well as central legal bodies are also exempted from tax regulation. In the case, an employee’s aged 60 or above and liable to take a lump-sum, then it is tax-free. Similarly, the benefit belongs to super pension, all the payment is tax-free except it is a member of a small number of Defined benefit plan categories. On the other hand, an employee contributing to an approved superannuation capital is included under section 80C to the total limit of the Australian taxation system (ATS) at three levels such as contribution retained by a superannuation capital, investment income, and benefits paid by capital source. Similarly, the MPP (minimum pension payment) is considered as a set percentage of total account savings at commenced on 1 July for each subsequent period (Kingston and Thorp, 2019). Some of the key exception that is taken into account such as:

- In the case employees earn $37000 or less, then tax is paid back into their super account by low-income super tax offset (LISTO).

- In income along with the super contribution is incurred together is higher than $250000, then they have to pay division 293 tax with an additional 15%.

Application of DBP

In the case of a defined benefit plan, the retirement amount is computed by taking into account the value of salary earned during the total service period. Generally, the plan could be benefited to all employees that are at least 21 years of age as well as worked for around 1000 hrs for an organization in a previous period. In fact, two-year service is a must for a participant as long as they will be 100 % vested quickly at the time of application for the plan (Yang, 2019). According to IRS limitation, one might borrow from a defined benefit plan by taking into account two options such as either $10000 or 50% of total account income whichever is the higher, and a total amount of $50000. However, it has been seen that this particular plan is getting less popular due to the private sectors' technique for attracting employees, although, it provides a fixed value benefit to employees at the time of retirement. In most situations, an employee often gains value as a fixed sum provided due to this plan. On the firm side, it could normally contribute highly each year other than the defined contributed plan.

CONCLUSION

Throughout the entire project report, it has been concluded that social security is a major source of support for many present retirees. According to the current research, it has been found that present territory workers that expect it to be its most valuable retirement income source are not confident regarding their retirement plan. For a participant in a defined benefit plan, it is important to have financial planning if a worker is to use these superannuation benefits to their best. The current trends towards increased active participation in a defined benefit plan mean that more employees bear the liability for determining where to invest their capital. Therefore, an increased understanding of investing will be useful to a defined benefit plan to obtain the right goals that can generate a maximum return in the future.

RECOMMENDATION

From the above analysis, it has been identified that employees need to acquire maximum benefits from their total savings. Therefore, they need to have maximum benefits from the defined benefit plan at retirement. Thus, it has been suggested to provide monthly payment option facilities so that its regular saving could be maintained effectively. On the other hand, the government needs to provide an additional amount of leverage on the basis of an employee’s performance and its contribution made to the company. Apart from this, the simple and fast accessibility of payment options needed to be available to the plan holder.