- Home

- Free Samples

- Business Skills

- BUS707 Significance Of Advanced Techn...

BUS707 Significance of Advanced Technology In Finance And Accounting Assessment 4 Answer

BUS707 Applied Business Research T220

Assessment 4

Assessment type: Report Individual. Research Plan. Written proposal – approximately 3,500 words

Purpose: This assessment is designed to allow students to present and justify appropriate method(s) for a research project designed to address the research question posed. This assessment relates to learning outcomes a, b and d.

Assessment topic: Business Research Proposal

Task Details: There are two components of the assessment: Written proposal and Oral presentation

Based on the Research Question developed in Assessment 2, students should develop a research design aimed at providing insights and/or answers to the question. Students should make any recommended adjustments to the content of Assessment 2, based on feedback provided, prior to including it in Assessment 4.

This assessment requires students to choose and justify the most appropriate research design, clearly explaining WHY the chosen design will best answer the research question and is most appropriate in the specific circumstances. Students should clearly justify their recommended research and analysis methods.

Note: Other than in exceptional circumstances, Assessment 4 of this subject is intended to form the basis of the student’s Research Project in BUS710 Research Project, following appropriate adjustments recommended in feedback

Written Proposal: the proposal will contain the following information:

- Title page: including research title and student’s details

- Abstracts: A brief summary of key information about the research (the research questions, the theory used and methodology plan).

- Research Background (revision version of Assessment 2)

- Research Questions and Research objectives (revision version of Assessment 2)

- Literature review (based on Assessment 3 – structured literature review), minimum 20 peer-reviewed articles (including the four main articles used in Assessment 3)

- Research Design: describe type of research, research approach, type of data, data collection methods, data analysis methods and sampling plan.

- Ethical Consideration : address the five ethical consideration of human research

Answer

ABSTRACT

Technology has gained the attention of world in this competitive era where overall globe is surrounded with modern technologies and preferring advanced tools for performing personal as well as professional activities. Therefore, this project will also outline the significance of advanced technology in finance and accounting industry where things are getting changed in various ways. Initially, project will signify the research question which is designed on advanced tools like; what are the impact of modern technology in financial decision making process? Along with this, objective will also have covered for conducting further research in order to identify the accurate data on advanced technologies or Information technology role in financial industry. Furthermore, various research methodologies like; data collection tools, approach of research, sampling plan, data assessment methods and research design is going to be demonstrated. This will help in understanding the overall process and methods which are used by researcher in completing this research to attain the set objectives and questions.

PROPOSAL

1. Research background

According to the current situation, technological interventions are proliferating in the financial industry because they facilitate business in promoting accountability and transparency in the accounting department. Although the core base of accounting & finance are assets, liabilities, and equity of funds, principles of NPM (New Public Management) enforce the finance sector to consider enhanced or best practices to promote transparency & accountability of finance management. Instead of this, it is recognized that momentous accounting & finance management elements are also based on useful IT-Based solutions in a chronological way (Omoteso, 2012). The principal purpose of this department is to attain accounting targets in a progressive manner with the use of Activity-based costing to change the management of finance. Simultaneously, artificial intelligence tools of accounting are most effective for the financial field, which aids in delivering exemplary service to targeted consumers. In fact, modern technologies are preferred by the accounting department across the globe because it direct in various complex situations and assist the whole using e-accounting to manage the capital within computerized tools. It means that e-accounting is beneficial in providing administrative services of data by integrating various other information technology systems. In contrast with this, the implementation of technical tools in financial activities for enhancing the functionality, accuracy, and faster processing aids various industries in shortening the time of the overall business procedure. These are a few common trends which are supporting the accounting department in enhancing their functional activities by making it more energetic in every possible opportunity and challenge (Kokina and Davenport, 2017).

Somehow, IT-based solutions are playing a tremendous role in financial industries by facilitating the accounting team with numerous tools like Activity-based costing, online transactions, spreadsheets, and many more. Therefore, the advancement of AI equipment is supporting the financial team in reducing the possibilities of failures and increased the chances of further success by maintaining transparency. Thus, this overall research is going to analyse the IT tools or AI techniques that are facilitating finance and accounting departments in accomplishing various complicated activities (Moudud-Ul-Huq, 2014).

2. Research questions and objectives

As per the background of research, it is identified that AI tools are gaining worldwide attention, especially for improving finance and accounting services due to which it’s important to understand the concept in-depth manner. Therefore, this research's main objectives and research questions are mentioned as follows, which is going to be the base of the entire investigation.

Objectives

- To identify the modern or advanced technology which is used in the accounting & finance industrial sectors and its influence in supporting the financial decision-making process.

- Impact of new or advanced technological intervention in the finance and accounting industry.

- Identification of imperative and effectual factors of new or modern technological tools that empowering personalized experience.

- Assessing corrective suggestions in context with new or advanced technologies of the accounting & finance industry.

Questions;

- What are the modern introduced technologies used in the accounting & finance industry?

- How can the finance team identify the security challenges and advantages of emerging technologies like data analytics, cloud computing, mobile technologies, and big data?

- What are the recommendations for effective decision-making processes within the accounting & financial industry?

- What is the influence of new or modern technological intervention of the financial industry?

These above research objectives and questions indicate that this investigation is going to revolve around modern or new AI tools and their influence on the finance & accounting sectors. This research aim can only have obtained by preferring all the above objectives and questions because it will assist the researcher in the right direction with clear queries. It means that the researcher has to find out the various new or modern AI technologies which are used by the accounting department to enhance their business services or functions (Issa, Sun and Vasarhelyi, 2016).

3. Literature review

Belfo & Trigo, 2013 depicts that an accounting information system is commonly known as workstation which is based on modern tools for seeking bookkeeping entities in a team with the help of information technology assets. Artificial intelligence system is accountable in helping collected works, storage and dispensation of fiscal as well as bookkeeping data that are preferred for in-house administration choice making. Moreover, AIS is consist of three main technologies such as; transaction processing systems, general ledger system & financial reporting system and Management report system. Author has also illustrated few useful features of implementing technology which are creative in accounting department and support finance team a lot.

Web services facilitate finance team in communicating through IoT tools and provide accurate data to the accounting team to make effective decision. Emergence of mobile is another wireless technology which consist of numerous features such as; how e-commerce is going to administered, provided important information in minimum time and assist verdict makers in various complex circumstances (Mirzaey, Jamshidi and Hojatpour, 2017).

According to assessment 2 articles, collective themes and findings of four articles are dealing with the subject of accounting creativity but in distinctive places.

In the first article, author has mentioned that how accounting is progressed and technologies are developed for supporting several industries. It means that main objective of first article is find out that how technology has replaced the manual work with the introduction of new technology with outstanding components. Therefore, article has given the glimpse of accounting technologies and how it changed the manual activities to technologies which support business in expanding more. As an outcome, first article has presented the technological elements in a broad view and managers are having numerous alternatives to select that how things is going to be implemented as well as options will support in selecting variety of assets in available categories (Wu, Chen and Olson, 2014).

In second article, researcher wants to identify that how ERP model is described and its development help the company in advanced way. It is identified that ERP system is a packages of software which consist of several tradeways like; mechanized, chains of supply, money, manpower, financial planning and client property initiatives. It means that companies have to decided that how managerial team can implement the software in workplace and develop entity for understanding that whether the ERP is useful for business or not.

Whereas, third article analyse that how accounting approaches is influencing the nations like Spain where accounting information system was executed in the domain of IT within business financial or accounting department. Therefore, ERP technique was blessing for countries like Spain to enhance their strategies and facts. It means that third article defines that how technology of accounting is grew in Spain and author has recognised that this country is giving too much importance to information technology that how IT tools will help in developing accounting methods instead of covering its benefit in business activities. As a result, this article finds that Spain is using technology and having an objective of enhancing these technologies to obtain its greater influence in business of nations. Their main target is to enhance the technology of a country for supporting those technologies which is going to further use in business activities (Hall and Pesenti, 2017).

In the fourth article of literature review, researcher has come to know about the IT role in accounting technology, financial accounting and managerial accounting as well as how these terms of accounts are sorted out. Thus, it is identified that how board of directors and venture capitalist are making decision for implementing these advanced technologies as a business development. Mainly, author has determined that these technologies has been developed as an accounting system and information which supported business to become stronger as compared to others in marketplace (Ennals, 2012).

Apart from these articles, there are various authors which has introduced the effectiveness of Artificial intelligence in the performance of accounting entities. As per the research or article of Odoh longinus Chukwudi and et. Al., (2018) artificial intelligence is instantly reforming the operating activities of financial associations and expecting to increasingly over taking the core functions due to the cost savings or operational efficiencies. In this current scenario, various tremendous enhancement in AI tools has increased the importance of this technology. It’s a branch of computer science which is concentred with the study of developing of computer system to support entities to come up with instant solutions without consuming maximum time. AI is a system which acquire new concepts and activities as well as draw a conclusion on the world that is easily understood in a natural language. Author has also depicted various technologies of AI in this paper such as; expert systems, robots, neural networks, fuzzy logic, natural language processing, intelligent agents and genetic algorithm. All the tools are supporting financial department and accounting sections at various stages so that they can enhance their business decision making process (Chui, 2017).

On the other hand, Haitham Nobanee, (2020) demonstrated that artificial intelligence has provided many signs of development which support financial team in attaining their set targets. This author claims that AI has replaced the human fully and partially as well as improve the performance of finance sector beyond the set benchmarks with the help of various programs. Simply, artificial intelligence has obtained the modern diffusion trends of current markets and this idea is practically utilized by diversified industries to gain competitive advantage in this running world. In fact, incredible invention of artificial intelligence is leading the entire sectors in modernized ways but mostly financial sector. AI is applied by financial sectors to reduce the time period, cutting the cost and adding the values in products with faster direction. At the same time, author has also reported that successful leading international based corporate financial industries are fully based in Artificial intelligence tools (Pascual, 2015).

4. Research design

4.1 Type of research

According to the protocol of research, careful study associated with specific problem with the use of suitable methods is known as research. As per the American Sociologist Earl Robert Babbie; it’s a systematic technique of investigating to describe, explain, predict and control the observed circumstances. There are mainly three types of noteworthy research such as; qualitative, quantitative and mixed research. All the three are distinct from one another in various ways and used by researcher according to the defined questions or aims (Mackey and Gass, 2015). Qualitative research consists of theoretical information whereas quantitative investigation is fill with numerical or statistical data. But mixed research is a combination of qualitative and quantitative research which means that researcher is involved in obtaining theoretical as well as numerical facts to address the set problem. Therefore, this research is based on qualitative because main objective of investigation is to accumulate theoretical information on AI role in accounting & financial industries. Qualitative research enforce researcher to acquire theories and facts for understanding the relationship between two variables. Hence, this style of research has supported researcher in acquiring depth information on set questions and make accurate judgment on AI effectiveness in financial industries (Flick, 2015).

4.2 Research approach

In research protocols, experts have designed the research approach which comprises plan and process of various steps on the basis of wider forecasting for detailing the suitable methods of data collection, assessment and interpretation. It’s mainly depend upon the nature of research problem that needs to be addressed. There are mainly three different types of research approach such as; inductive, deductive and abductive one (Choy, 2014). All the three approaches are differing from one another and gives conclusion differently which are mentioned as follows;

| Deductive | Inductive | Abductive | |

| Logic | In this approach, premises are genuine and end results or conclusion are also true. | As per this approach, known premises is going to be preferred by researcher for generating untested summary. | In this style, known premises are utilized by researcher for creating testable summary. |

| Generalizability | It comes from general to particular result. | In this style, researcher use specific information for giving general end. | In this mode, communications are take place between particular to general for making any final assumptions. |

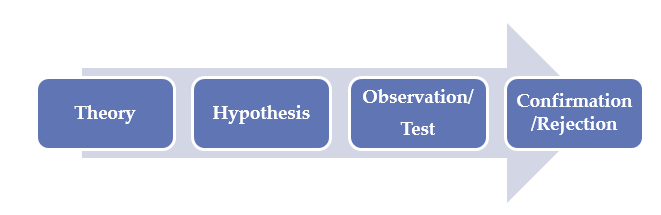

According to above table, it is understood that deductive approach is having a set of hypothesis which needs to confirmed while investigation process. There are certain stages which are followed in deductive research approach such as;

This above diagram indicate that researcher is having a theory at initial stage which further move for observation and testing to confirm the objectives or results.

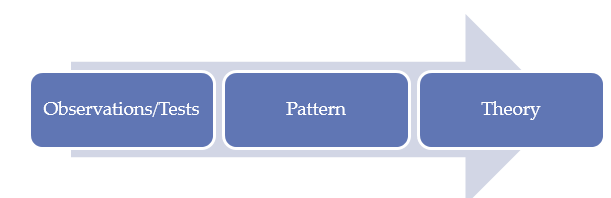

On the other hand, inductive approach is not having any formulation or hypothesis whereas it begins with research questions, aims and objectives to attain it further while entire research process (Tuohy and et.al., 2013). Thus, an appropriate route of inductive approach is shown below.

According to the above flow chart, it is identified that researcher is having an observation at initial stage and follows the pattern to generate theory for coming at final conclusion. It means that research of “AI impact on financial and accounting industry” is based on inductive approach where known premises has been generated into general conclusion to come up with final solution. This shows that research is having a knowledge that AI is an outstanding tool which helps financial industry or accounting department in attaining set targets. Therefore, inductive approach is beneficial for this research which helps in understanding the impact of AI in the success of financial industry (Wiek and Lang, 2016).

4.3 Type of data

Researcher experts has classified the data into two types one is theoretical and other is numeric which portrays in different ways. These two type of data are helpful in various situations like; if a researcher have to obtain some statistical or number facts to interpret the facts then quantitative data will be useful. Whereas if researcher need to acquire the theoretical information in which facts are detailed in descriptive way then qualitative data is suitable. In this research, qualitative method is used for collecting “theoretical information” for analysing the role of AI in context with financial industries or overall accounting field (Novikov and Novikov, 2013).

4.4 Data collection methods

There are mainly two types of data collection tools such as; primary and secondary which are preferred by researcher in different phenomenon. Primary method is used for collecting first hand facts which means that acquired data is going to use for a first time. But secondary method of data collection provides second hand data which are already preferred or utilized by overall public. Some of the major tools of primary are; questionnaire, survey, testing, interview, self-experimentation whereas secondary tools consist of public sources like; articles, research papers, newspapers, magazines, previous records of companies and many more. It means that both the tools are providing various types of information which are distinctive in accuracy, validity and reliability. In this research, researcher has used secondary sources for collecting relevant data on the specific subject because secondary tools provide multiple alternatives for making final conclusion. Main source which is used by researcher in this research are various articles and previous researcher papers to understand the effectiveness of Artificial intelligence in the success of financial department (Jamshed, 2014).

4.5 Data analysis methods and sampling plan

Analysis of data is an appropriate procedure of converting collecting facts into relevant information which is going to further use by researcher or business while making final decision. In this research, investigator has obtained data from various articles but finalize it by assessing the data with the help of suitable method such as;

- Statistical analysis

- Predictive analysis

- Prescriptive analysis

- Diagnostic analysis

All of them are differing in nature but for this research, prescriptive analysis tool has been used for supporting investigator while making final decision from the raw of data. This tool is preferred by researcher to make verdict on time horizon from instant to long term growth. Whereas, sampling plan is another term used by researcher for indicating the base on which investigation has been conducted. In this research, various articles and AI effective tools has been used a sample for identifying the final data (Üstün and Eryilmaz, 2014).

5. Ethical consideration

Ethics is considered as a moral principle of an individual that assists human beings while performing any activities, mostly direct the etiquettes to conduct error-free research. This term is also known as a branch of knowledge that deals with moral principles for ensuring that the researcher will perform all the activities in the right way without harming anyone's interest. Basically, research is a very long process which comprises multiple stages with different motive such as; the introduction part covers the background; the literature review section collects data from various sources, findings interpret the collected information at final assumptions, etc. All the stages of human research consist of the necessary information and projecting something that needs to be authentic without targeting any particular group, person, or association. It's an ethical element that the researcher will ensure that every aspect of research must free from any criticism which might harm the life of any individual, society, company, and associations. It means that ethical consideration is a significant element of human research, consisting of various norms, provisions, rules, and regulations to reduce the probabilities of any illicit activities (King and Mackey, 2016). Somehow it acts as a base or fundamental element of human research which enforce researcher to consider some noteworthy concepts such as;

- Participants of study should not be put in danger in any mode.

- It's an obligation of the researcher to respect respondents' dignity, and it should be at first priority.

- Full consent must acquire from respondents or sources of information before beginning the study.

- It's the responsibility of the researcher to ensure the safety and privacy of participants.

On the other hand, informed consent is another essential ethical issue that is raised in the research, which means that an individual knowingly, voluntarily, and intelligently with a clear mind gives permission on any term. Additionally, the principle of beneficence is also essential for researchers, which incorporates the professional mandatory for accomplishing appropriate investigations to serve or encourage the welfare of constituents. At the same time, a researcher is liable to maintain participants' confidentiality and anonymity, which is closely linked with the authorities of beneficence, respect towards dignity, and fidelity. There are mainly two theories that also need to consider by research such as utilitarian and deontological theory but both the approaches are differing from one another. Utilitarian theory enforce investigator to concentrate on society's happiness to focus on the best interest of research, whereas deontological theory avoids the outcome of moral duty and somehow not liable to prevent community. This situation creates ethical dilemmas, but human ethics or moral principles force an individual or human to consider all the above-mentioned elements to minimize the chance of illegal activities (Alghamdi and Li, 2013).