- Home

- Free Samples

- Financial Accounting

- ACC1AIS Financial Analysis Of Ahmed C...

ACC1AIS Financial Analysis of Ahmed Company Assessment Answer

ACC1AIS – Individual Assignment 2020

This assignment requires you to create a new business, input transactions, and generate financial statements and reports using Xero. This assignment question sheet should be used in conjunction with the weekly Xero help-sheets which explain in more detail the steps required to complete the exercises below.

Task Overview

The company for which you will be working in this assignment distributes, sell and repairs toys for kids. You will be recording transactions for the month of May 2020.

The assignment contains five separate sections, one for each week of May. You should work though these sections sequentially.

Set up Company

Your first task is to set up a new business in Xero

You are the accountant and owner of a business which is registered for GST purposes. You previously used to use another software as your main accounting system. However, as a result of changes in technology, you have decided to move onto a cloud-based accounting software platform, XERO. To transfer from your previous accounting package to XERO you are required to transfer balances in your previous system onto XERO. The conversion date (date when you stop using your previous system and start using XERO) is 1 May 2020, and the Trial Balance as at 30 April 2020 is as below:

Trial Balance as at 30 April 2020 | ||

Account | Debit | Credit |

Cash at bank | $114,608.24 | |

Accounts receivable | $91,531 | |

Prepaid Fire insurance | $20,000 | |

Inventory | $110,421.1 | |

Store Building | $540,000 | |

Accumulated Depreciation – Store Building | $272,250 | |

Delivery Van | $69,300 | |

Accumulated Depreciation – Delivery Van | $35,805 | |

Accounts payable | $56,981.30 | |

Loan payable – Building Head Office | $275,812.4 | |

Unearned delivery revenue | $18,700 | |

Capital | $286,500 | |

Sales revenue | $83,210 | |

Interest expense – 8% annually | $1,838.75 | |

Fire Insurance expense | $2,000 | |

Salaries expense | $25,080 | |

Warehouse rent expense | $2,100 | |

telecommunication expense | $550 | |

GST | $64,311.11 | |

Allowance for Doubtful Debts – 10% | $8,321 | |

Provision for warranty – 5% | $4,160.5 | |

$1,041,740.2 | $1,041,740.2 | |

All figures included within the Trial Balance are GST exclusive except for accounts receivable and accounts payable. | ||

Accounts receivable: 100 items of SKU02770, 150 items of SKU02771, 80 items of SKU02772, 70 items of SKU02773, 100 items of SKU02774, 110 items of SKU02775, 110 items of SKU02776 are sold on 15 April 2020 on credit to Kay Bee Toys. Due date is 18 May 2020.

Items sold on 15 April 2020 | Sales price (incl. GST) | Total receivable (incl. GST) |

SKU02770 – 100 items | $152.95 | $15,295 |

SKU02771 – 150 items | $155.45 | $23,317.5 |

SKU02772 – 80 items | $133.00 | $10,640 |

SKU02773 – 70 items | $84.45 | $5,911.5 |

SKU02774 – 100 items | $117.49 | $11,749 |

SKU02775 – 110 items | $88.85 | $9,773.5 |

SKU02776 – 110 items | $134.95 | 14,844.5 |

Total incl. GST | 91,531.00 |

Accounts payable: 150 items of SKU02770, 160 items of SKU02771, 110 items of SKU02772, 100 items of SKU02773, 100 items of SKU02774, 140 items of SKU02775, 140 items of SKU02776 are purchased on 20 April 2020 on credit from Wonder Workshop. Due date is 20 May 2020.

Items purchased on 20 April 2020 | Purchase price (incl. GST) | Total payable (incl. GST) |

SKU02770 – 150 items | $76.47 | $11,470.5 |

SKU02771 – 160 items | $77.72 | $12,435.2 |

SKU02772 – 110 items | $66.50 | $7,315 |

SKU02773 – 100 items | $42.22 | $4,222 |

SKU02774 – 100 items | $58.74 | $5,874 |

SKU02775 – 140 items | $44.42 | $6,218.8 |

SKU02776 – 140 items | $67.47 | $9,445.8 |

Total incl. GST | $56,981.30 |

Inventories on hand at 30 April 2020: 450 items of SKU02770, 210 items of SKU02771, 330 items of SKU02772, 130 items of SKU02773, 200 items of SKU02774, 280 items of SKU02775, 150 items of SKU02776, and 140 items of SKU02777.

Items on hand 30 April 2020 | Purchase price (excl. GST) | Total excl. GST |

SKU02770 – 450 items | $69.52 | $31,283.2 |

SKU02771 – 210 items | $70.65 | $14,837.46 |

SKU02772 – 330 items | $60.45 | $19,950 |

SKU02773 – 130 items | $38.38 | $4,989.63 |

SKU02774 – 200 items | $53.40 | $10,680 |

SKU02775 – 280 items | $40.38 | $11,306.90 |

SKU02776 – 150 items | $61.34 | $9,200.45 |

SKU02777 – 140 items | $58.38 | $8,173.46 |

Total excl. GST | 110,421.10 |

Salaries expense | $25,080 per month |

Warehouse rent expense | $2,310 per month incl. GST |

Telecommunication expense | $605 per month incl. GST |

Allowance for doubtful debts | 10% of the Accounts Receivable |

Provision for warranty | 5% of the sales revenue |

Interest expense on loan (Building Head Office) | Calculated at 8% per annum |

Delivery Van | Purchased on 1 March 2015 at $76,230 incl. GST, with a useful life of 10 years, and no residual value. It is depreciated using the straight-line method. |

Store Building | Purchased on 1 April 2010, at $594,000 incl. GST, with a useful life of 20 years, no residual value. It is depreciated using the straight-line method. |

Fire insurance | On 1 March 2020, you paid $26,400 incl. GST for a twelve-month fire insurance policy to Berkshire Group. |

Refer to the Workshop 2 Help-sheet if you need detailed help to create new items.

Item code | Item name | Buy price (Incl. GST) | Sell price (Incl. GST) |

SKU02770 | Man TGA low loader truck with JCB backhoe loader | $76.47 | $152.95 |

SKU02771 | Scania R-Series Liebherr Crane With Light Sound | $77.72 | $155.45 |

SKU02772 | CAT Mini Excavator Vehicle | $66.50 | $133.00 |

SKU02773 | Snowplow | $42.22 | $84.45 |

SKU02774 | MACK Granite Halfpipe Dump Truck | $58.74 | $117.49 |

SKU02775 | JCB 5CX Eco Backhoe Loader | $44.42 | $88.85 |

SKU02776 | Truck Vehicle - Mack Granite Truck Power Fuel | $67.47 | $134.95 |

SKU02777 | Mack Granite Garbage Truck – Green | $64.22 | $128.45 |

Date | Details |

1 May | You borrowed $40,000 from the Northern Bank on a short-term loan. The money is to be used to purchase plastic welding machinery. The principle, plus 8% annual interest, will be paid in 4 months. |

1 May | You purchased 20 items of SKU02770, 10 SKU02771, 15 SKU02772, and 12 SKU02773 from BTC Distribution. You received all the stocks ordered and paid 20% of the purchase price together with the freight of $209 incl. GST. You agreed to pay BTC Distribution the balance on 3 June. |

1 May | You paid $5,500 incl. GST for a three-month product liability insurance policy to CoverWallet. |

1 May | You received $16,280 incl. GST cash in advance from clients for a 6-month subscription to your company featured magazine, “Humpty Dumpty”. |

1 May | You received $13,200 incl. GST in advance from ThinkFun for repair of toys. |

2 May | You spent $748 incl. GST on miscellaneous office supplies at Officeworks. You paid for these from your bank account. Consider purchase of supplies as a prepaid asset account. |

2 May | You spent $41,800 incl. GST on a plastic welding machinery and paid for it by using your bank account. You estimate that the machinery will have a useful life of 5 years, during which you are planning to produce 16,500 units of new toys. The residual value of the machinery is $5,000. Actual number of units of toys that will be produced over the next 12 months will be 1,200 units. Note that the trial Company in Xero does not allow you |

Answer

Running Head: Financial Analysis of Ahmed Company

Key Benchmarks

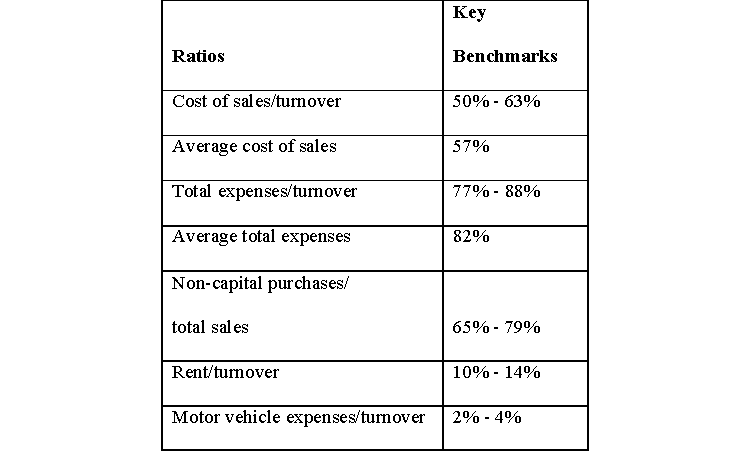

By comparing with performance of Ahmed with the industry benchmark can provide an insight about how well Ahmed has been performing during the month of May 2020. Ahmed cost of sales to turnover ratio is 36.9% which is lower than the industry benchmark of 57% (ato.gov.au.2020). Hence, Ahmed is able to purchase goods at a lower cost than the industry average. The total expenses to turnover ratio amounted to 71.3% which is lower than the industry benchmark of 77% - 88%. It can be deducted that Ahmed has been able to manage is expenses more effectively than the industry average. The average total expenses is 82.5% which is nearly the same as the industry average. The rent turnover ratio and motor vehicle expenses ratio are respectively at 2.6% and 1.6% are lower than the benchmark which is an indication of the low expenses conducted by Ahmed.

Ahmed Company compared with Funtastic Limited

Profitability Ratios

The results show that the profitability ratios of Ahmed are relatively higher than its competitor, Funtastic Ltd. Ahmed is generating a gross margin of 63.1% compared to a negative margin of 21.10% from Funtastic. This implies that the management of Ahmed is in a position to yield higher returns in the form of gross profit. On the other hand, both companies are generating a negative net profit margin. The net profit margin of Ahmed is higher than Funtastatic, which means that Ahmed is in a better position to manage its costs.

Financial Ratios

The liquidity position of Ahmed is better than Funtastic Ltd. Ahmed has generated a current ratio of 3.2 compared to 1.4 from Funtastic. Hence for every dollar of its short-term debt, Ahmed has $3.2 in terms of assets which can be quickly converted into cash to repay its obligations. Similarly, Ahmed has a lower debt accumulation as its debt ratio is lower than Funtastic Ltd. Hence, it can be deduced that Ahmed has a better liquidity and financial position than Funtastic.

Recommendations

The financial analysis carried out provides evidence that Ahmed has to improve its profitability position as currently it is generating a negative net profit margin. Hence Ahmed need to become more efficient in the management of its operating expenses. The company should be reviewed its operating costs. Secondly, the current ratio which stands at 3.2 is very high. This means that Ahmed has an excess working capital liquidity. Hence, this excess liquidity could be used to repay the loan taken from the bank. Additionally, Ahmed can invest the excess liquidity to generate higher returns or invest in the non-current assets of the business. The company also have a high inventory level and by making use of an effective inventory management, it could create a better financial position for Ahmed.